Regional Trends Move the Mobile Device Market

New worldwide market research shows vast differences between the mobile device markets in each region. The most noticeable trend has been the rapid increase in smartphone sales. Nokia took the lead in the overall market with palmOne in second still atop of the US market, while Clie sales for Sony slumped.

“There are quite significant differences in vendor performance and product choices across EMEA, the Americas and the Asia/Pacific region,” said Chris Jones, Canalys director and senior analyst.

Nokia 1st, palmOne 2nd

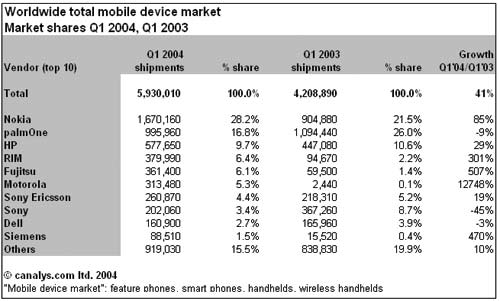

Nokia was the overall worldwide mobile device market leader in Q1, but the gap between it and the other top companies, like palmOne and HP, is much smaller outside EMEA than inside. Nokia’s share of the mobile device market in EMEA in Q1 was 48%, but globally it is only 28% according to the Canalys estimates. In EMEA, Nokia dominates the smart phone segment with a 73% share, while palmOne only has around 1%, behind Motorola and several non-US firms including Sony Ericsson, Siemens and Orange. In North America, the situation is quite different: palmOne is the leading smart phone vendor with 37% share, ahead of Nokia (25%), Motorola (16%) and Samsung (15%). Nokia’s share in APAC, a region that accounts for a third of the global market for smart phones, is similar, but it is behind fellow Symbian-based vendor Fujitsu, with Motorola again in hot pursuit.

“These regional differences can have quite profound effects on future global market progression,” Jones added. “It is very easy for companies in a strong position in one territory to assume they can carry that success into others, but a product design and brand that is accepted in, for example, the US, may not do so well in Europe or Asia, and vice versa. In the smart phone and wireless handheld segments the vendor’s operator relationships are also critical.”

Indeed, it is only since RIM expanded its operator relationships across Europe and introduced features that mobile professionals in that region have come to expect, such as color screens, that it was able to break into the top rank of mobile device vendors there. RIM was number four worldwide in Q1 2004 according to Canalys, with North America accounting for just under 80% of shipments compared to over 90% a year earlier.

GPS navigation has given a big boost to the handheld market in EMEA, with total shipments for all vendors in Q1 2004 up 20% on the same period one year ago. Meanwhile, in North America and APAC, handheld shipments fell year-on-year by 26% and 11% respectively. HP benefited from being included in large numbers of navigation solution bundles in EMEA and has remained ahead of palmOne there for three consecutive quarters. On a worldwide level, however, palmOne continues to enjoy a considerable lead over HP, largely due to its stronger US retail performance: PalmOne still ships two handhelds to every one of HP’s in North America, though the ratio has fallen considerably over the past year.

Smartphone Shifting

The difference in product trends is highlighted further by the shifting category mix Canalys has observed in the different regions. In Q1 2004, smart phones represented 63% of mobile device shipments in EMEA, up from 35% a year earlier, with handhelds falling from 40% to 29% (though still growing in absolute terms). In the Asia/Pacific region, the smart phone proportion rose from 30% to 69% over the course of a year, with handhelds falling from 53% to 27%. In North America, however, handhelds still account for the majority of mobile device shipments, but have fallen from a very high 83% to 59%, while smart phones have increased from 10% to 23%. As the number and range of smart phones available on the market increases, handhelds will come under even more pressure.

Sony Suffering

Among the top 10 worldwide vendors, Sony has probably suffered the most from the decline in the North American handheld market, which accounts for the vast majority of its CLIÉ business, with shipments almost halving year-on-year. “Being very consumer focused, Sony’s handheld business hasn’t really benefited much from the general upturn in business mobility spending, while at the same time what were once distinguishing features, such as integrated cameras and MP3 playback, have appeared on more devices, including mobile phones, from other vendors,” Lashford added.

The Canalys worldwide research encompasses both connected and unconnected mobile devices, for example smart phones like the Sony Ericsson P900 and palmOne Treo 600, wireless handhelds such as the RIM BlackBerry range and T-Mobile MDA II, and handhelds like the HP iPAQ h1940 and Sony CLIÉ TJ37. Inclusion of all these different types of device provides a firm foundation for analysing the trends emerging in the various regions.

Article Comments

(2 comments)

The following comments are owned by whoever posted them. PalmInfocenter is not responsible for them in any way.

Please Login or register here to add your comments.

![]() Comments Closed

Comments Closed

This article is no longer accepting new comments.

How do the OSes shake out?

Then there is Symbian. How many of those Nokias are running Symbian? And who else runs it?

Anybody seen these numbers?

David

=========================

David Beers

Pikesoft Mobile Computing

www.pikesoft.com

Latest Comments

- I got one -Tuckermaclain

- RE: Don't we have this already? -Tuckermaclain

- RE: Palm brand will return in 2018, with devices built by TCL -richf

- RE: Palm brand will return in 2018, with devices built by TCL -dmitrygr

- Palm phone on HDblog -palmato

- Palm PVG100 -hgoldner

- RE: Like Deja Vu -PacManFoo

- Like Deja Vu -T_W

My phone

--

"I'm not a cool person in real life, but I play one on the Internet".

Galley