Smartphones Showed Strong Growth in 2007

Canalys' annual smart mobile device, aka smartphone, report for 2007 has just been released. Their data shows that worldwide converged device shipments (smart phones and wireless handhelds) rose 60% to hit 115 million in 2007. Year-on-year growth climbed every quarter throughout 2007, to reach a peak of 72% in Q4. Shipments in North America alone more than doubled 2006 figures to 20.9 million units.

Annual Highlights from the report include:

- Converged device shipments (smart phones and wireless handhelds) rose 60% to hit 115 million in 2007

- Shipments of handhelds fell 47% to 3.0 million, from 5.6 million in 2006

- APAC is the largest region by volume – 47.9 million units in 2007, ahead of EMEA at 45.9 million

- North America is growing fast – shipments doubled to 20.9 million, from 10.3 million in 2006

- Nokia remained global market leader, shipping 60.5 million smart phones

- RIM shipments grew 112% year-on-year to 12.2 million, strengthening its second place position

- By OS provider, Symbian leads on 67% share, followed by Microsoft on 13%, with RIM on 10%.

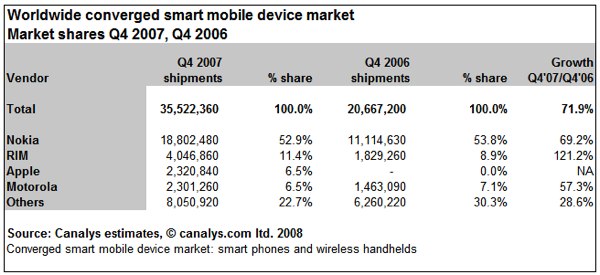

Q4 highlights – converged devices

- Converged device shipments rose 72% year-on-year in Q4 2007, the highest growth seen all year

- Nokia and RIM retained their number one and two positions

- Apple achieved third place despite its limited geographic coverage, with 7% share

- APAC converged device shipments rose 23%, EMEA 79%, and North America 222%

- Symbian leads with 65% share, ahead of Microsoft on 12%, RIM on 11%, Apple on 7%, and Linux at 5%

Apple’s entry into this market in 2007 with the iPhone sparked a lot of media attention and speculation about how much it could disrupt the status quo and take share away from companies such as Nokia, RIM, Palm and Motorola. “When you consider that it launched part way through the year, with limited operator and country coverage, and essentially just one product, Apple has shown very clearly that it can make a difference and has sent a wakeup call to the market leaders,” said Pete Cunningham, Canalys senior analyst. “What it must demonstrate now is that it can build a sustainable business in the converged device space, expanding its coverage and product portfolio. It will also need to ensure that the exclusive relationships that got it so far so quickly do not prove to be a limit on what it can achieve. Apple’s innovation in its mobile phone user interface has prompted a lot of design activity among competitors. We saw the beginnings of that in 2007, but we will see a lot more in 2008 as other smart phone vendors try to catch up and then get back in front. Experience shows that a vendor with only one smart phone design, no matter how good that design is, will soon struggle. A broad, continually refreshed portfolio is needed to retain and grow share in this dynamic market. This race is a marathon, but you pretty much have to sprint every lap.”

Canalys estimates that Apple took 28% share of the fast growing US converged device market in Q4 2007, behind RIM’s 41%, but a long way ahead of third placed Palm on 9%. This was also enough to put Apple ahead of all Windows Mobile device vendors combined, whose share was 21% in the quarter according to Canalys figures. In EMEA, where the iPhone officially launched part way through the quarter in only three countries, Apple took fifth spot behind Nokia, RIM, HTC and Motorola, but ahead of several established smart phone providers such as Sony Ericsson, Samsung and Palm.

For the full year 2007, as in 2006, the Asia Pacific region was the biggest in volume terms for converged device shipments. Apple has of course not yet launched the iPhone in the region, and many vendors who are successful in other parts of the world, such as RIM and Palm, have also made relatively little impact there so far. Nokia continues to lead in the region, with more than 50% share in converged devices, ahead of Japanese smart phone vendors Sharp and Fujitsu. Motorola, despite enjoying fourth place, has seen its Linux-based smart phone shipments in the region fall 28% from their high in 2006.

“The mobile Linux opportunity remains just that – an opportunity,” added Rachel Lashford, manager of Canalys in APAC, “Total Linux-based phone shipments in 2007 were almost flat on 2006. There is still too much fragmentation and not enough momentum for any single open standard around which the energy of developers, manufacturers and operators can coalesce.”

Nokia’s recent announcement of its intention to acquire Trolltech will no doubt have raised questions among some of Trolltech’s mobile phone producing partners about their Linux implementation strategy going forward. Meanwhile Google’s Android initiative, like others before it, remains an idea yet to turn into viable commercial products widely accepted by both mobile network operators and the mass market. Although off to a slow start, Canalys expects Linux will account for a significant proportion of mobile phone shipments within the next few years.

Lashford continued: “Rising consumer interest in having a rich, high-speed browsing experience on a mobile device, and the demand for visually sophisticated navigation and location applications will attract more companies into this arena. Flattening mobile data costs, and the advertising-funded possibilities generated by location-based services, will help reduce usage barriers. Improvements in the underlying technologies and innovation in user interfaces will lead to more usable devices. All these factors will help push the high-end mobile phone and smart phone segments forward. Meanwhile supply-side concerns around time to market and build and support costs will drive the industry to look for economies of scale. Mobile Linux can have a big part to play in this future, but at the moment the maturity of the other mobile operating systems puts them a long way ahead.”

In Q4 2007, Canalys estimates that Symbian had a 65% share of worldwide converged device shipments, ahead of Microsoft on 12% and RIM on 11%. By region, Symbian led in APAC and EMEA with 85% and 80% shares respectively, while in North America RIM was the clear leader on 42%, ahead of Apple on 27% and Microsoft at 21%.

Source: Canalys Research Release.

Article Comments

(7 comments)

The following comments are owned by whoever posted them. PalmInfocenter is not responsible for them in any way.

Please Login or register here to add your comments.

The marketshare numbers suggest...

RE: The marketshare numbers suggest...

fast-forward 6.5 years.....

Responding to questions from New York Times correspondent John Markoff at a Churchill Club breakfast gathering Thursday morning, Colligan laughed off the idea that any company -- including the wildly popular Apple Computer -- could easily win customers in the finicky smart-phone sector.

"We've learned and struggled for a few years here figuring out how to make a decent phone," he said. "PC guys are not going to just figure this out. They're not going to just walk in.'"

http://www.palminfocenter.com/news/9110/colligan-laughs-off-iphone-competition/

**********************************************************************************

Nearly a decade later, Palm are STILL ILL-PREPARED for larger "palmtop" screens. They'd rather just keep respinning SSS (small square screens) on increasingly feature-deficient "me too" smartphones.

Pilot 1000-->Pilot 5000-->PalmPilot Pro-->IIIe-->Vx-->m505-->T|T-->T|T2-->T|C-->T|T3-->T|T5-->TX-->Treo 700P

...which is why the Palm we know is loosing ground.

This race is a marathon, but you pretty much have to sprint every lap.

Watching the way Palm has been operating, I'm left with the feeling that they still think they are the only runner on the track. I'm afraid they were asleep (or was it simply denial) when the other runners blew by them. (But maybe they are just so far behind at this point that from their position it just looks like there are no other runners.)

Symbian is not a better OS. Like MS Windows though, it just comes pre-installed on all those gazillion Nokia phones. I'm still interested is seeing what Apple and some version of Linux can do. If somehow the almost unbelievable happens and that "Linux" is Palm's, so be it. But I'm certainly not waiting for them in an specific way. It's not as if Palm's hardware is particularly compelling either. But so far my TX keeps plugging along and I can't find any compelling reason to upgrade (or is it "downgrade") to anything I'm seeing available right now.

"twrock is infamous around these parts" (from my profile over at Brighthand due to my negative 62 rep points rating)

Well duh

Hint to Palm et al: put the same level of fancy-new-tech into a device sans the phone part, then see how well that sells. Apple already caught on with the iPod Touch (although it still falls very short in too many ways to be a true Palm replacement, it's still miles beyond anything Palm has produced in recent years).

Otherwise the companies are just skewing these stats by what they choose to make. What next? Hershey reporting that their chocolate is selling better than their motor oil?

RE: Well duh

PDA's Past and Present:

Palm TX (Number 2)

Palm - IIIxe, Vx, M500, M505, Tungsten T, TX

Handspring - Edge, Platinum, Deluxe

Sony - SJ22

Casio-EM500

Apple - MP110, MP2000, MP2100

market share

Sachin

http://editorial.co.in

Latest Comments

- I got one -Tuckermaclain

- RE: Don't we have this already? -Tuckermaclain

- RE: Palm brand will return in 2018, with devices built by TCL -richf

- RE: Palm brand will return in 2018, with devices built by TCL -dmitrygr

- Palm phone on HDblog -palmato

- Palm PVG100 -hgoldner

- RE: Like Deja Vu -PacManFoo

- Like Deja Vu -T_W

Pure Touchscreen Smartphone

Wake up Palm!!! We need a Big Screened Treo. At least one Model. Is that so difficult do do?